The stablecoin market map - CB Insights Research

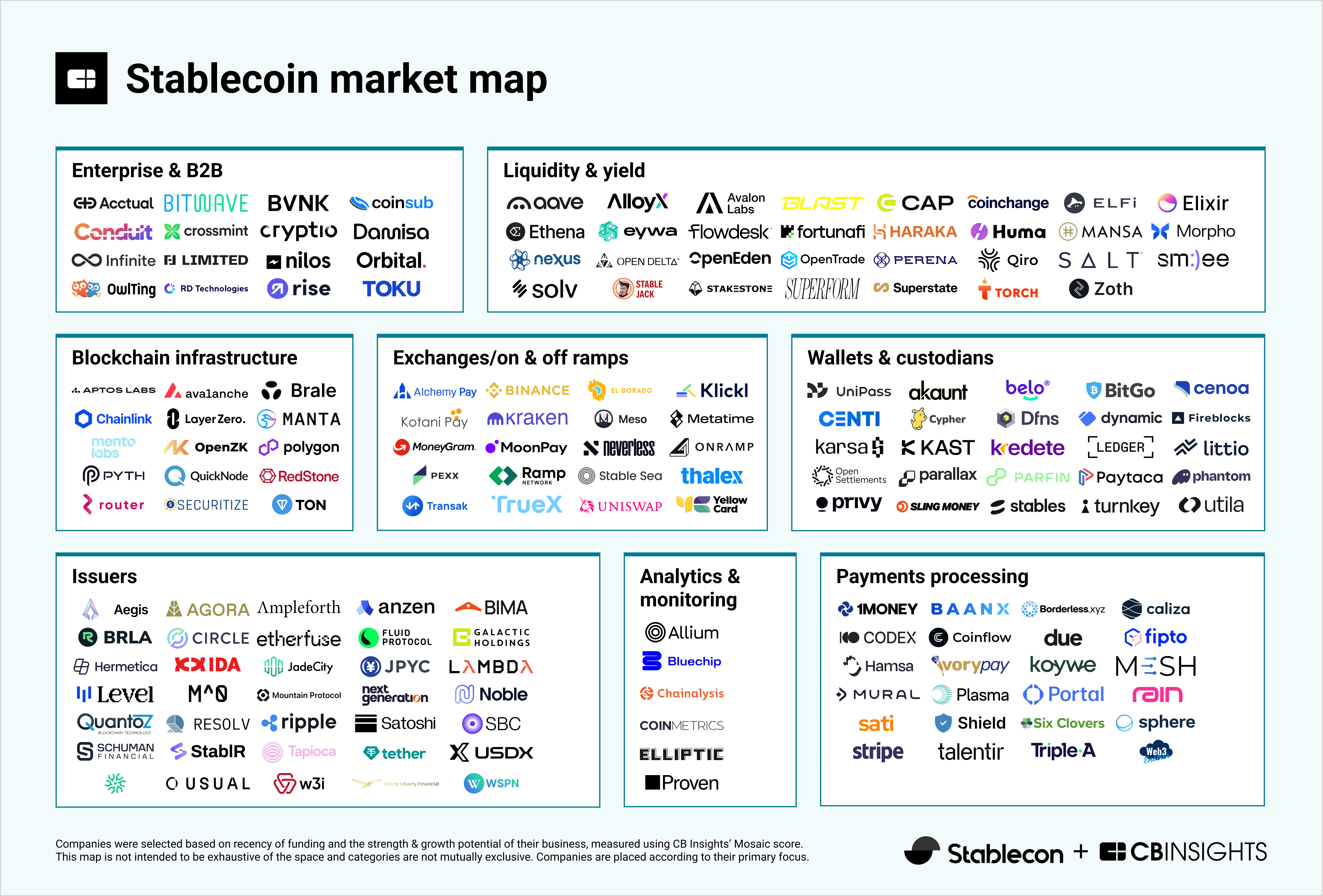

In partnership with Stablecon, we leveraged CB Insights’ Business Graph data to identify and map 172 high-momentum companies powering the stablecoin ecosystem across core infrastructure, consumer financial services, and enterprise solutions.

https://www.cbinsights.com/research/stablecoin-market-map/?utm_content=334163269&utm_medium=social&utm_source=twitter&hss_channel=tw-110171914

In partnership with Stablecon, we leveraged CB Insights’ Business Graph data to identify and map 172 high-momentum companies powering the stablecoin ecosystem across core infrastructure, consumer financial services, and enterprise solutions.

Funding to stablecoin companies is projected to rise to $12.3B in 2025 — more than 10x 2024’s $1B in funding. This unprecedented growth reflects several major developments in the space, including mainstream financial institutions entering the market, expanding use cases beyond transactions, and growing regulatory clarity worldwide.

In partnership with Stablecon, CB Insights has created a market map to help enterprises and investors identify high-growth markets and companies within the stablecoin ecosystem.

After analyzing 600+ companies, we selected 172 recently funded players that demonstrate strong momentum — as measured by CB Insights’ Mosaic score, which assesses private-company health and growth potential based on funding data, personnel, market strength, and online sentiment. We then mapped these companies across 8 categories based on their primary focus.

Please click to enlarge.

Key takeaways

1. Stablecoins are laying the foundation for a new era of crypto-native banking

Stablecoins are solving a key obstacle to cryptocurrency adoption: volatility. Unlike traditional cryptocurrencies, stablecoins maintain consistent value through ties to underlying assets.

This stability has attracted major players in traditional finance: Mastercard and Visa now enable stablecoin transactions, while established banks Societe Generale and Vantage Bank have begun issuing their own stablecoins. Established blockchain infrastructure providers like Zero Hash and Fireblocks (founded in 2017 and 2018, respectively) are facilitating this mainstream adoption by providing technology geared toward enabling traditional financial institutions to integrate stablecoin capabilities.

Wallets & custodial solutions have experienced the highest average headcount growth (83%) of any market map segment over the past year. Examples include Littio and Open Settlements, which offer custodial services that store and manage stablecoins on behalf of consumers while providing traditional banking features like payments and transfers. Another notable player is KAST, a stablecoin account provider that has increased its headcount by 10x YoY (to more than 40 employees) and secured $10M in funding in December 2024. KAST offers cards compatible with Apple Pay, Google Pay, and ATMs, and recently announced plans to evolve into a full-fledged on-chain bank.

Stablecoin issuers are also developing innovative approaches to address the limitations of USD-pegged stablecoins, such as Ampleforth ’s cost-of-living-indexed stablecoins that adjust for inflation and Ethena ’s synthetic stablecoins that don’t require traditional banking reserves. Stablecoin issuers represent the largest category on the market map by number of companies and have the highest average M&A probability (24%) among segments. This signals high consolidation potential as the market matures and highlights the strategic value of stablecoin issuance to established financial players.

2. Liquidity & yield use cases are transforming stablecoins from passive stores of value into high-growth financial instruments

Stablecoins are evolving into yield-bearing tools and liquidity products, expanding beyond their traditional role as safer alternatives to high-risk cryptocurrencies. For example, established stablecoin issuer Paxos recently introduced a yield-bearing stablecoin, Lift Dollar (USDL). And following its $1.1B acquisition of Bridge last fall, Stripe added payment capabilities for Bridge’s USDB stablecoin, which generates yield through backing by BlackRock money market funds.

The liquidity & yield category, which includes liquidity mining, lending services, and yield-bearing stablecoins, has attracted $2.3B in funding across 40 deals over the last 12 months — the most funding of any category. Although $2B of this was a flexible, scalable credit line for institutional crypto lender and stablecoin issuer Avalon Labs, the funding intensity signals strong investor interest in this nascent category — the liquidity & yield category has the lowest Commercial Maturity score of all markets, with companies averaging Level 2: Validating (i.e., introducing their products to the market through validation and testing).

The category’s growth potential is best exemplified by StakeStone, a cross-chain liquidity protocol that has secured 7 funding rounds since early 2024, while more than doubling its Mosaic score in just over 6 months (from 444 in November 2024 to over 900 in May 2025).

3. Cross-border payments are becoming the breakout use case for stablecoins, especially outside the US

International payments have emerged as a crucial application for stablecoins, with every company in the payments processing category supporting cross-border payments infrastructure. The role of stablecoins varies by region: in countries with robust traditional banking, they serve as specialized alternatives to fiat currency for specific use cases, while they provide more affordable and accessible USD alternatives in emerging markets.

This global appeal is reflected in investment patterns — among companies included in this market map, those based outside the US attracted more than half of all deals in the past 12 months. Major payment companies such as Mastercard, Visa, and Stripe have also entered this space through stablecoin card payments, transaction settlement, and analytics projects. This entry by established payment giants signals mainstream validation of stablecoin infrastructure and suggests that digital currency payments are moving from experimental to essential for competitive positioning in global payments.

The payments processing segment is relatively early in its commercial development, with half of the companies in this category still in the first 2 levels of Commercial Maturity (developing or piloting their products). However, these companies demonstrate significant growth potential — based on CB Insights’ estimates, we expect them to receive $454M in funding in 2025. That’s more than 10x the $45M they received in 2024, when excluding Stripe’s $694M round (the payments processor had not yet launched stablecoin payments at that point).

Market descriptions

Mosaic scores are dynamic and subject to change. Mosaic scores as of May 2025.

Analytics & monitoring

Platforms, tools, and services that track, analyze, and provide insights into stablecoin operations, transactions, and market behaviors. These solutions help users, regulators, and stakeholders understand stablecoin performance, ensure compliance, manage risk, and make data-driven decisions.

- Total funding within last 12 months: $18M

- Total deals within last 12 months: 4

- Top companies by Mosaic:

- Chainalysis (861 Mosaic): Transaction monitoring and risk intelligence for blockchain companies

- Elliptic (773 Mosaic):Transaction monitoring and analytics for stablecoin issuers

- Coin Metrics (713 Mosaic):Blockchain data and analytics, including dedicated stablecoin coverage

Blockchain infrastructure

Fundamental technological layers, networks, and services that enable stablecoins to operate effectively across multiple blockchain environments. These infrastructure providers deliver the essential technical foundation upon which stablecoin systems are built, operated, and scaled.

The companies in this category offer critical components of the technical stack required for stablecoins to function effectively, including layer-1 blockchains, oracle networks, cross-chain messaging protocols, scaling solutions, and developer tools.

- Total funding within last 12 months: $51M

- Total deals within last 12 months: 10

- Top companies by Mosaic:

- Securitize (917 Mosaic):Digital securities issuance platform for tokenization of assets, including the frxUSD stablecoin in partnership with Frax

- Aptos Labs (866 Mosaic): Layer-1 blockchain which supports Circle ’s Cross-Chain Transfer Protocol and USDC on-ramp services via Stripe

- TON (851 Mosaic):Layer-1 blockchain which supports stablecoin payments

Enterprise & B2B

These platforms, services, and solutions are specifically designed for businesses to integrate, manage, and use stablecoins within their financial operations. They frequently support use cases such as B2B payments, payroll, treasury operations, and customer-facing payment options, while managing the associated regulatory, accounting, and operational requirements.

- Total funding within last 12 months: $125M

- Total deals within last 12 months: 15

- Top companies by Mosaic:

- BVNK (844 Mosaic):B2B and B2C stablecoin payments infrastructure including an embedded wallet for cross-border fiat and stablecoin transactions

- OwlTing (832 Mosaic):Its OwlPay solution includes wallet and fiat conversion services geared towards B2B stablecoin transactions

- Rise (803 Mosaic):A cross-border fiat and stablecoin payroll solution

Exchanges/On & off ramps

Platforms and services that facilitate the conversion between stablecoins and other assets, including fiat currencies (e.g., USD, EUR) and other cryptocurrencies. These services provide the essential bridge between traditional financial systems and the stablecoin ecosystem.

The companies in this category include both centralized exchanges with stablecoin support and specialized on/off-ramp services designed to make it easier for users to enter and exit the stablecoin ecosystem across different regions and payment methods.

- Total funding within last 12 months: $2.3B

- Total deals within last 12 months: 9

- Top companies by Mosaic:

- Binance (931 Mosaic): Crypto exchange which recently entered a strategic partnership with Circle, expanding USDC availability to consumers and adopting USDC for its corporate treasury; received a historic $2B investment in the form of stablecoin from MGX earlier this year

- MoonPay (895 Mosaic):On- and off-ramp and crypto payments solution that recently partnered with Mastercard to enable stablecoin payments via its recent acquisition of Iron (APIs for stablecoin infrastructure)

- Klickl (849 Mosaic): Crypto and stablecoin infrastructure including exchange, custody, payments, and off-ramp services

Issuers

Organizations and protocols that create, distribute, and manage stablecoins. These issuers are responsible for the provision and ongoing operations of stablecoins in the market.

The companies in this category represent diverse approaches to stablecoin issuance, including fiat-backed stablecoins, crypto-collateralized stablecoins, algorithmic stablecoins, and regional currency stablecoins, each with their own mechanisms for maintaining stability and addressing specific market needs.

- Total funding within last 12 months: $279M

- Total deals within last 12 months: 36

- Top companies by Mosaic:

- Ripple (905 Mosaic):Established blockchain infrastructure provider that launched the RLUSD stablecoin in December 2024 and introduced it into cross-border payments in 2025

- Circle (903 Mosaic):Issuer of the USDC and EURC stablecoins, recently introducing a stablecoin orchestration layer for global payments

- World Liberty Financial (871 Mosaic):Issuer of the USD1 stablecoin introduced in March 2025, which is the currency of choice for MGX ’s $2B investment in Binance

Liquidity & yield

Platforms, protocols, and services that enable users to deploy stablecoins productively to earn returns, provide market liquidity, or access lending/borrowing capabilities. These solutions transform stablecoins from purely transactional instruments into yield-generating assets.

Providers range from those focused on capital preservation to more aggressive yield-seeking methods, catering to different risk appetites within the stablecoin ecosystem.

- Total funding within last 12 months: $2.3B

- Total deals within last 12 months: 40

- Top companies by Mosaic:

- StakeStone (918 Mosaic):Cross-chain liquidity protocol which recently partnered with World Liberty Financial to support USD1

- Flowdesk (834 Mosaic): Market maker providing trading infrastructure, recently appointed to provide liquidity for Societe Generale ’s EURCV stablecoin

- Ethena (830 Mosaic): Its synthetic stablecoin USDe, backed by other cryptocurrencies, offers greater opportunities for staking/yield generation than a fiat-backed stablecoin

Payments processing

Platforms and infrastructure that facilitate the use of stablecoins for everyday commercial and personal transactions. These solutions enable businesses and individuals to send, receive, and process stablecoin payments efficiently and securely.

- Total funding within last 12 months: $187M

- Total deals within last 12 months: 23

- Top companies by Mosaic:

- Stripe (929 Mosaic):Payments processor that recently rolled out stablecoin business accounts across 100 countries and partnered with Ramp on stablecoin-based corporate cards

- Rain (857 Mosaic): Card issuance and payments platform for stablecoin transactions

- Mesh (854 Mosaic):Crypto payments network that recently introduced crypto-to-stablecoin retail payments via Apple Pay

Wallets & custodians

Applications, platforms, and services that enable users to securely store, manage, and transact with stablecoins. These solutions range from self-custody wallets where users control their private keys to custodial services where providers manage crypto assets on behalf of users.

Approaches to stablecoin management range from hardware wallets and mobile applications for individual users to sophisticated custodial infrastructure for enterprise clients.

- Total funding within last 12 months: $237M

- Total deals within last 12 months: 19

- Top companies by Mosaic:

- Fireblocks (912 Mosaic):Its blockchain solutions include custodial white-labeled wallets, and it recently partnered with Chainlink Labs to create a stablecoin solution for banks

- Phantom (901 Mosaic): Multichain wallet supporting cryptocurrencies including stablecoins

- BitGo (899 Mosaic):Offers custodial solutions, including stablecoin reserve assets management for USD1, and has stated intent to launch a stablecoin of its own

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

...........................................................................................................................................

If you aren’t already a client, sign up for a free trial to learn more about our platform.