Thread by @GLC_Research

https://x.com/GLC_Research/status/1925883825650819170 In an era defined by information overload and AI-driven noise, Kaito introduces a new market paradigm where attention becomes a measurable, monetizable asset.

This report outlines the products, vision, market, and valuation framework that position Kaito as a leader in the web3 attention economy.

This Kaito thesis was developed in collaboration with our friend

, analyst at

You should definitely check him out, he consistently shares high-quality insights and valuable alpha.

Let’s get into it.

##

The Rise of InfoFi: Monetizing Attention

Since the early days of the crypto economy, X has established itself as the primary hub for information flow within the industry. It has become the go-to platform where crypto projects, KOLs, and users gather to share, discuss, and consume content.

But the algorithm controls the flow of attention. This results in a poor distribution of information, where high-quality insights are often buried beneath hundreds of low-value, engagement-driven posts.

In an era where AI has made content creation easier than ever, what truly holds value, and deserves fair compensation, is the attention that content generates. This is especially true in the crypto space, where attention carries intrinsic value by driving capital flows, shaping narratives, and influencing market outcomes.

Unfortunately, that value is often distributed in ways that are disconnected from actual merit. InfoFi represents a new paradigm where attention is allocated and rewarded by market forces.

This is arguably the closest source of truth.

InfoFi was needed and could help our industry gain greater credibility by leveraging market forces to direct attention toward high-quality content, gradually displacing the low-value noise that has dominated CT for far too long.

##

Kaito Offerings: Service, Platform & Market

Kaito aims to become the interoperable InfoFi layer that sits atop the internet’s walled gardens, creating a fundamentally new way for creators, users, and brands to connect.

For a clearer understanding of Kaito’s business model, it’s useful to refer directly to founder Yu Hu’s explanation in his

“Kaito InfoFi Vision” article.

- Info as a Service - Kaito API & Kaito Pro

Kaito API and Kaito Pro transform unstructured information into structured data and actionable insights - powering third-party applications, research, trading, strategic decisions, and more.

- Kaito API is one of the most widely used APIs for AI agents and LLM applications in crypto, powering platforms like FalconX, Sentient, and others.

- Kaito Pro is trusted by over 700 teams across protocols, funds, infrastructure providers, and research desks

Web2 Comp: Bloomberg API and Bloomberg Terminal

Web3 Adaptation: A data flywheel powered by user-owned data and monetization - enabling Kaito to access and unlock value from all of the internet’s walled gardens.

2. Info as a Platform - Kaito Yaps & Kaito Connect

Kaito Connect is a digital marketplace where brands, creators, and users meet - powered by AI and market-driven signals to enable efficient, transparent, and scalable matchmaking.

- Yapper Leaderboard – A fairer, more transparent, and higher-signal go-to-market model for projects and creators

- Kaito Earn – Delivering the right incentives to the right users, optimized for high-precision user conversion

- Capital Launchpad – A next-gen AI matchmaking system that optimizes for interest-and value-aligned community capital, leveraging rich offchain and onchain signals

Web2 Comp: Facebook, TikTok, Uber, etc.

Web3 Adaptation: Algorithmic discovery meets market-driven signaling - combining AI with InfoFi to power an open, incentive-aligned network.

3. Info as an Asset - Kaito Markets

Kaito Markets transforms information - mindshare, narratives, sentiment, and more - into a tradable asset class, unlocking an entirely new market primitive.

Long term, Yu sees massive potential in enabling a wide range of information markets across sectors and verticals.

##

The Expanding TAM of InfoFi

With up to 90% of internet content

to be AI-generated by 2026, the signal-to-noise ratio in crypto is set to deteriorate even further. The space already suffers from information overload, across X, Telegram, Discord, forums, and trading terminals. As generative AI floods these channels with even more content, finding reliable and actionable insights becomes nearly impossible without intelligent filtering.

As information becomes abundant, quality curation grows scarce and valuable.

This is the core of the InfoFi thesis: monetizing structured intelligence and rewarding those who surface it.

The 90% stat underscores Kaito’s mission, not just to organize data, but to build a new market around its value.

This shift is supported by broader trends. The blockchain analytics market is

to grow at a CAGR of over 25.85%, reaching $13.97 billion by 2030, driven by the demand for structured crypto intelligence, already proven by platforms like Nansen and Messari.

[

](https://x.com/GLC_Research/article/1925883825650819170/media/1925460391473065984)

Meanwhile, the content intelligence market, essential for filtering massive data streams, is

to grow from $2.68B in 2025 to $28.86B by 2034, at a CAGR of over 30%.

As InfoFi becomes foundational to web3 infrastructure, tools like Kaito are well-positioned to scale with this trend.

So far, crypto has been an attention-driven economy. In the short to mid term, volatility and narratives often outweigh fundamentals. In this environment, capturing and redirecting attention is a powerful form of alpha for market participants.

Kaito reframes information as an asset. By combining AI-powered intelligence with token incentives, it introduces a new InfoFi paradigm, rewarding users for engagement and compensating creators for insight.

Just as social platforms reshaped content and Uber transformed transport, Kaito aims to redefine how attention and intelligence are valued in digital markets.

[

](https://x.com/GLC_Research/article/1925883825650819170/media/1925475894774157312)

##

Kaito Metrics: Revenue, Adoption & Ecosystem Value

With its clear vision and innovative product suite, Kaito has achieved something few projects in our industry manage to reach: product-market fit.

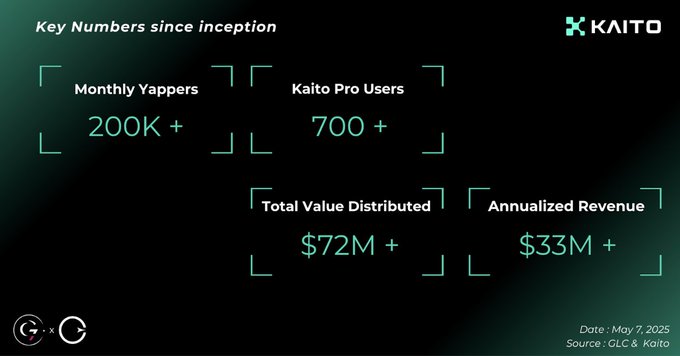

- Kaito Yaps, launched just five months ago, now boasts over 200,000 monthly active yappers. And it’s easy to see why, the product is simply outstanding. If you have an account on X and are actively engaged, Kaito is a must-have.

We see Kaito Yaps as a product with limitless potential, redefining how value is distributed in the attention economy. Our only regret: as a business account, we don’t have access to it.

- Then there’s Kaito Pro. Over 700 teams now use the platform for their daily operations. Its API has also become widely adopted by AI agents and LLM-based applications in crypto.

- Finally, Kaito Connect has introduced a fairer and more transparent go-to-market model for crypto projects, enabling them to launch marketing campaigns via branded leaderboards.

In five months, more than $72 million in rewards from ecosystem projects have been distributed to yappers, stakers, and holders, not including the

airdrop.

Kaito generated an annualized revenue of over $33 million, based on Q1 results, a 100x growth over the past 12 months.

And the momentum isn’t slowing down: founder Yu Hu has already confirmed that

[

](https://x.com/GLC_Research/article/1925883825650819170/media/1925464446345834496)

##

Valuation Analysis: Can Kaito Support $2B FDV ?

Valuation remains one of the most misunderstood aspects of web3.

The market is still inefficient, with valuations frequently driven by speculation, low float, sentiment or insider behavior. However, we believe the space is evolving, and intrinsic value is playing a growing role in how investments are assessed.

Our approach focuses on Kaito’s revenue and buyback mechanism to derive an estimate of intrinsic value.

When we began this research,

was trading at a way lower valuation, making the thesis particularly attractive. Since then, it has rallied and now trades at a ~$2B FDV.

This analysis aims to assess what growth would be required to support the current valuation.

Methodology

We clearly don’t have enough information at this stage to produce a highly precise valuation. More details on pricing, demand, upcoming products, and Kaito’s long-term goals would be necessary for a deeper analysis.

However, we do know that Kaito generated ~$33M in annualized revenue in Q1. Around 50% of that revenue is being used for token buybacks, and the project shows strong product-market fit with significant potential.

What the market is currently signaling is that it expects substantial growth ahead. At a ~$2B FDV, Kaito is trading at a 58x P/S multiple and a 115x P/E multiple (assuming 50% buybacks).

Let’s explore what kind of growth would be needed to justify this valuation, projecting out through the end of 2026 using different QoQ growth rates and market multiples.

Valuation Scenarios

We assume Kaito continues to grow quarter-over-quarter, driven by its competitive advantages and the significant market opportunity ahead. We model three scenarios: bear, base, bull.

Based on a P/S multiple of 15, the QoQ revenue growth range that appears consistent with $KAITO’s current valuation falls between 15% and 25%. By compounding these growth rates through the end of 2026, we estimate annualized revenue could reach approximately $90M to $160M, depending on the scenario.

After adjusting for current and projected token buybacks, this implies a potential token price range of $1.40 to $2.50.

To account for broader market conditions and variability in sentiment-driven valuation multiples, we also include a sensitivity analysis using P/S ratios of 10 and 25. This provides a more comprehensive view of potential pricing outcomes by the end of 2026.

[

](https://x.com/GLC_Research/article/1925883825650819170/media/1925473659461783552)

Ultimately, the P/S ratio required is unpredictable, as this market can be highly irrational, both to the upside and downside. Through a sensitivity analysis, we applied three different P/S multiples to derive valuation ranges for each growth scenario.

Using a football field approach, we identified the overlapping range across these cases to estimate the most likely outcome.

This leads us to a proposed price range of $1.70 to $2.50.

is currently trading at around $2, so the 15–25% QoQ growth range appears to be what’s priced in.

At current valuation levels, sustaining or justifying this pricing over the long term requires significant growth. That said, Kaito might very well hit, or even exceed, those targets.

[

](https://x.com/GLC_Research/article/1925883825650819170/media/1925473862759682048)

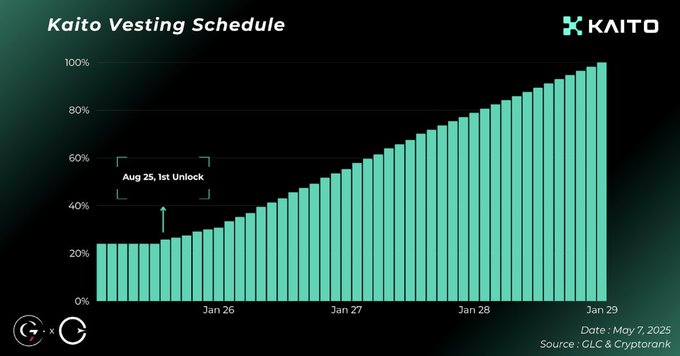

It’s also important to consider the downside risk. The market seems to have priced in a high degree of future growth, and with token unlocks on the horizon, there’s increased sensitivity. Upcoming unlock events combined with falling short of expectations could result in selling pressure.

Ultimately, while this framework is subjective, our view, based on various multiple ranges, is that Kaito would need to deliver 15-25% QoQ growth to support the current pricing.

What about the Upside ?

##

Earnings for KAITO stakers

Up to this point, our valuation framework has focused exclusively on revenue generated by Kaito’s underlying products. But in reality, this doesn’t capture the full picture: Kaito is also distributing a large amount of value directly to users and stakers.

recently announced upcoming drops from various projects

.

The best way to gauge the value of these drops is through

. Yield tokenization allows the market to speculate on future returns, and right now, sKAITO holders can earn a fixed yield of

with a 69-day maturity, that’s about 7% over two months (through PT).

This means the market currently prices in a 7% return on the staking pool over the next two months:

- The staking pool currently holds 21M $KAITO , and at a ~$2 price, that’s a $42M pool.

- So 7% of that equals roughly $3M in rewards expected to be distributed to stakers in the next two months.

- If sustained, this alone would add $16,3M in annualized earnings to holders, effectively taking annualized revenue from $32M to $48M, assuming consistency.

Below is a sensitivity analysis of the APY for sKAITO holders. Based on already announced drops, the market is currently pricing in approximately $16.3M in annualized rewards.

This analysis illustrates how the APY would vary with changes in the total value of drops distributed.

At current staking levels and $2

price:

- sKAITO holders are already receiving a very attractive yield.

- APY could go parabolic if large drops are announced.

- This could create significant buying pressure for $KAITO , as the implied yield would become even more compelling for stakers.

If this level of distribution proves consistent, the market is likely to adjust the token price accordingly to reflect the sustained yield opportunity.

[

](https://x.com/GLC_Research/article/1925883825650819170/media/1925580017817243648)

##

Focus on

Hyperliquid’s success made a strong impact on the industry, showing that a thriving project doesn’t require VC backing or CEX partnerships. Inspired by this,

and his team focused on building a product people truly wanted.

Once the foundation was solid, they refined it through user feedback and committed to a fair and transparent loyalty distribution. This culminated in an airdrop of 10% of the total supply, or 100 million

token to reward active users, partners, and contributors in the Kaito ecosystem.

The

token lies at the core of the InfoFi network and has several utilities:

- Market Dynamics: It empowers $KAITO holders to reclaim control over traditional distribution models by directly influencing how attention is allocated across the network.

- Native Currency: As the native token of the Kaito network, $KAITO facilitates all transactions within the ecosystem.

- Governance: It enables decentralized decision-making, allowing holders to propose and vote on changes to the network and algorithm, ensuring alignment between the community and the project’s evolution.

Only concern is inflation. Starting in August 2025, 75% of the total supply will be gradually released over four years.

[

](https://x.com/GLC_Research/article/1925883825650819170/media/1925476776999825409)

##

Aligned Stakeholder Interests

- Strategic Reserve: Kaito is one of the few early-stage projects to have already implemented a buyback program. Since March, the team has been using project-generated revenue to build a strategic reserve of its native token, repurchasing a total of 3.87 million $KAITO at a cost of $4.3 million.

At the current rate of approximately $1.5 million per month, this corresponds to an annualized buyback exceeding $18 million.

- Founder commitment: Yu personally purchased 1M $KAITO tokens for $1.4M in March, using his own funds. He subsequently staked these tokens, making him the second-largest staker of $KAITO .

has also voluntarily imposed self-unlock conditions on his holdings:

- 50% unlock when the protocol reaches $50 million in revenue

- 100% unlock at $100 million in protocol revenue

This is a rare move among founders and a clear demonstration of his conviction and commitment to the success of the protocol.

- Staking “The BNB of Attention” : Since the token launch in February, the amount of $KAITO staked has steadily increased, recently surpassing 21 million tokens, which represents 8.7% of the 241 million currently in circulation.

[

](https://x.com/GLC_Research/article/1925883825650819170/media/1925585641431019521)

This growth reflects the Kaito team’s continued commitment to making

both useful and valuable. Much like Binance’s launchpad, which has delivered consistent value to BNB holders over the years, Kaito aims to position itself as “the BNB of attention.”

Since the launch of Yaps five months ago, more than $72 M in rewards from ecosystem projects have been distributed to Yappers, stakers, and token holders.

As seen in the sKAITO holders’ earnings section, this trend appears likely to continue.

##

Risks and Considerations

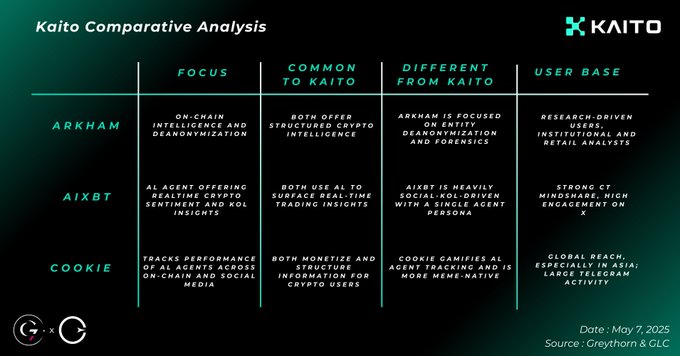

Kaito is building in a space that’s becoming increasingly competitive, with several projects now racing to define the future of AI-powered crypto intelligence and tokenized insights. The table below highlights how it compares to other key players in this emerging InfoFi sector.

[

](https://x.com/GLC_Research/article/1925883825650819170/media/1925586125134934019)

Kaito currently holds the highest market cap ($445M) among its peers, despite having the lowest circulating supply ratio (24.1%), a sign of strong early demand and holders confidence in its broader vision. This low float means upcoming token unlocks could create pressure, and it remains to be seen whether the token can sustain such valuations.

While Kaito stands out as a best-in-class social data tool, it now faces credible competition from Cookie DAO, a rising player building infrastructure for analyzing AI agents across blockchain and social ecosystems. Cookie offers a more accessible alternative, with many features available for free and a growing user base. With a $228M FDV compared to Kaito’s $2.1B, the valuation gap is significant.

But competition is healthy. This dynamic should drive innovation and ultimately benefit the broader market.

Additional risks stem from Kaito’s reliance on AI-driven ranking and aggregation systems. While effective, these introduce challenges around transparency, data quality, and potential bias. In fast-moving markets like crypto, flawed inputs or opaque logic can surface misleading or incomplete insights, impacting user decisions.

There’s also the risk of overemphasizing select partner projects, which could undermine content neutrality and lead to perceived bias. Sustaining long-term trust will require a careful balance between algorithmic efficiency and a fair, merit-based approach to information delivery.

As AI tooling continues to evolve, Kaito’s models will need ongoing refinement to stay competitive. Falling behind in performance, integrations, or personalization could weaken its core value proposition.

##

Final Thoughts

Kaito has quickly positioned itself as a leader in the InfoFi space, combining strong execution, real product-market fit, and a timely vision. Its model of quantifying and monetizing attention is gaining real traction with over $33M in annualized revenue and wide adoption across its product suite.

Beyond core revenue, Kaito is also distributing significant value to users and stakers, over $72M to date, with more drops on the way. At current staking levels, sKAITO holders earn a 39% APY, as seen on Pendle. If this continues, it could drive buying pressure as users seek yield exposure.

However, upcoming token unlocks and already-priced-in growth expectations introduce risk. If execution slows or narrative weakens, this could lead to selling pressure. Sustained delivery will be key.

Kaito enters this next phase from a position of strength but the bar is high. If it keeps delivering, it has the potential to not just meet, but exceed expectations.

In a noisy market, Kaito is building the signal.

If you found this research valuable, please consider liking, commenting, reposting, and following

,

, and

. This type of deep-dive analysis takes time, and your support truly means a lot.

Big thanks to our friend,

, who co-led this research, a sharp analyst who deserves far more visibility in the space.

And a special shoutout to

,

, and the entire Kaito team for their insights and support in strengthening this report.

Appreciate you all.

GLC.

Disclaimer This research note has been prepared based on GLC’s current market outlook and convictions regarding the cryptocurrency market. It is critical to emphasize that investing in cryptocurrencies and digital assets involves significant risk due to their inherent volatility and unpredictability.

The information provided here is for educational and informational purposes only and should not be interpreted as financial or investment advice. Market trends and projections are subject to change due to unforeseen events, and short-term volatility may lead to substantial price fluctuations.

We strongly encourage you to perform your own due diligence and research before making any investment decisions. Nothing in this document should be considered an endorsement to buy or sell any particular asset.

Never invest more than you are willing to lose, and ensure that you fully understand the risks associated with this market.

GLC assumes no responsibility for any losses incurred as a result of using this information.

As always, DYOR.