Thread by @VannaCharmer

https://x.com/VannaCharmer/status/1904203981456539972 Perception is everything in the token arena. Much like in Plato’s allegory of the cave, many investors are trapped in shadows—misled by distorted projections of value from bad actors. In this piece, I will expose how VC-funded projects systematically engage in the following to make it easier to manipulate the price of their tokens:

- Keep the FALSE float of their token as high as possible.

- Keep the REAL float as low as possible (helps them pump the token).

- Pump the price of their tokens by leveraging the fact that the REAL float is very small.

##

Moving from the low float/high FDV meta to the false float/high FDV meta.

[

](https://x.com/VannaCharmer/article/1904203981456539972/media/1903941591464599552)

Nooo, I’m not a low float/high fdv token! I’m “COmmUnITy FIrSt”

Earlier this year, memecoins skyrocketed in popularity, pushing VC-backed tokens off meta. These tokens became known as ‘low float/high FDV’. With the launch of Hyperliquid, many of these VC-backed coins have become uninvestable. Instead of addressing their flawed tokenomics or focusing on developing real products, some projects chose to double down on keeping their circulating supply artificially low while publicly claiming the opposite.

Suppressing the float benefits these projects, as it makes price manipulation significantly easier. Backroom deals—where foundations sell locked tokens for cash and later repurchase them in the open market—become far more capital efficient. It also creates extreme risk for short-sellers and leverage traders, as a low real float makes these tokens highly susceptible to price pumps and dumps.

Let’s get to some examples of what’s happening. This is by no means an exhaustive list:

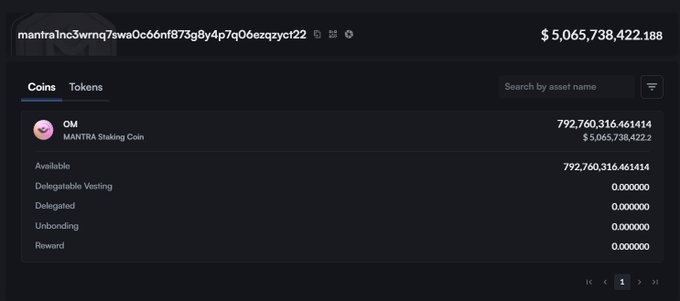

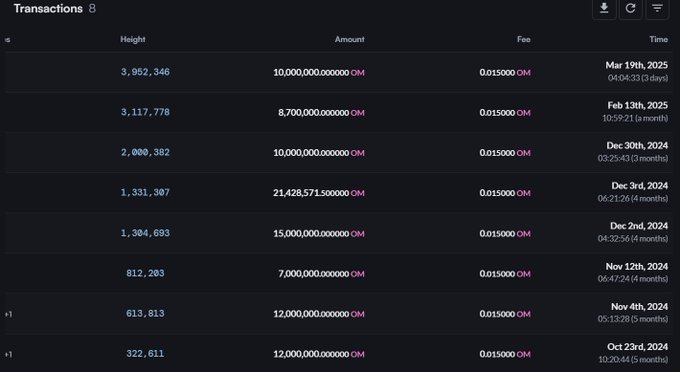

- @MANTRA_Chain This is the most blatant one, for those wondering how it’s possible for a project with only $4m in TVL to have an FDV north of 10b the answer is very simple: They’re in control of most of the $OM float. Mantra holds 792 OM (or 90% of the supply) in ONE SINGLE wallet. This is not sophisticated; they were too lazy to even bundle the supply.

[

](https://x.com/VannaCharmer/article/1904203981456539972/media/1904014826847838208)

mantra1nc3wrnq7swa0c66nf873g8y4p7q06ezqzyct22

When I asked

about it, he said this was a mirror bucket wallet, this is complete bullshit.

[

](https://x.com/VannaCharmer)

1261

856

Mosi

@VannaCharmer

·

回复

It’s clear that

is blatantly lying. A proper mirror bucket wallet should deploy tokens only in response to a bridge transaction, not make random multi-million dollar transactions or seed team members’ wallets so they could sybil their own airdrop. If what he’s

-———-谷歌翻译———–

很明显

@jp_mullin888

公然撒谎。

适当的镜桶钱包应仅用于响应桥梁交易而部署令牌,而不必进行随机数百万美元的交易或种子团队成员的钱包,以便他们可以自己的空投。如果他是什么

[

](https://x.com/VannaCharmer/status/1903247422169506145/photo/1)

[

](https://x.com/VannaCharmer/status/1903247422169506145/photo/2)

[

1.4万

](https://x.com/VannaCharmer/status/1903247422169506145/analytics)

Now, how do we know what’s the real float of Mantra?

We can calculate it by taking:

980M (Circulating supply) - 792 OM (The part of the float that the team controls) = 188M OM

This 188M OM number is probably not accurate either. The team still holds a significant part of OM that they used to sybil their own airdrop, rinse more exit liquidity, and further control the float. They deployed ~100M OM to sybil their own airdrop, so we’ll be removing from the real float as well. You can check more info of that on the below:

[

](https://x.com/SolanaLeeky)

1205

SolanaLeeky

@SolanaLeeky

·

OM$0.38753

the investigation into the flow of $OM tokens between Mantra team wallets and potential Sybil farmer wallets The price of $OM recently hit $7, which is quite impressive. Meanwhile, Mantra has identified over 26 million $OM as Sybil tokens and plans to burn them—a commendable

-———-谷歌翻译———–

对Mantra团队钱包和潜在的Sybil Farmer钱包之间$ OM令牌流的调查

$ OM的价格最近达到了7美元,这给人留下了深刻的印象。同时,咒语已将超过2600万美元的OM确定为Sybil代币,并计划燃烧它们 - 值得称赞的

[

2.7万

](https://x.com/SolanaLeeky/status/1902197977852109030/analytics)

This leaves us with… Ba dum tss… only 88M OM as the real float! (Assuming the team doesn’t control more of the supply, which seems like a terrible assumption). This makes Mantra’s real float ONLY 526m. A GIGANTIC difference from the $6.3B number they have on CMC.

[

](https://x.com/VannaCharmer/article/1904203981456539972/media/1904023692994060288)

A lower real float makes it easy to manipulate the price of OM and liquidate any shorts. Traders should be scared to short OM. The team controls the majority of the float and can pump and dump the price at will. It’s like trying to trade against

on a shitcoin. I suspect that Tritaurian Capital—a company that

(

is a co-founder of SOMA and Tritaurian is owned by Jim Preissler, JPM’s boss at trade io) loaned $1.5 million to—along with a few funds and market makers in the Middle East, may be behind the current price action. This further tightens the real float and makes it even more difficult to calculate it.

This likely explains their reluctance to release the airdrop and the decision to implement vesting periods. If they had gone ahead with the airdrop, it would have significantly increased the real float, likely tanking the price.

This is not complex financial engineering, but it does seem like a deliberate plot to reduce the real float of the token and pump the price of OM.

2.

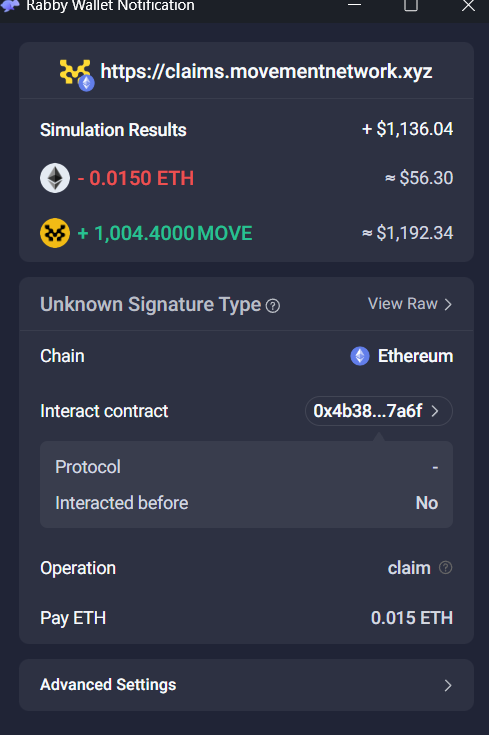

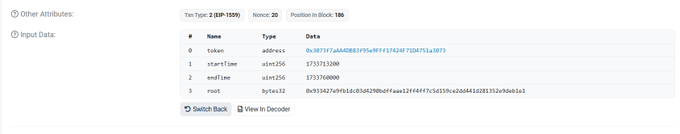

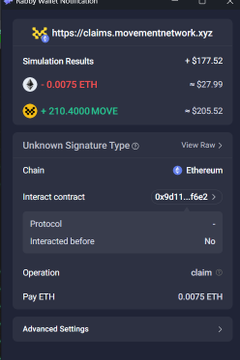

During their claim process Movement offered users that they could either: Claim their airdrop on ETH mainnet or claim on their non-existent chain for a small bonus. After a couple of hours of the claim, they:

- Added a fee for all claims on ETH mainnet, which was 0.015 ETH or $56 at the time on top of ETH’s gas fee, this priced out most of the testnet users who had small balances.

- Reduced ETH mainnet allocations by more than 80% while keeping the fee.

- Stopped the claims.

- Restricted the claims between very tight deadlines

[

](https://x.com/VannaCharmer/article/1904203981456539972/media/1904045372948783104)

[

](https://x.com/gtx360ti)

1200

@gtx360ti

·

Claims paused for some reason now (contract says start again at 4pm GMT) . Also reduced the fees to 0.0075 ETH https://etherscan.io/tx/0x94e329b4c3cf971079137b22f660997057bf00ede1ca67d824c4920a71c2210b… No wonder price went uponly Only 40million $MOVE has been claimed so far (?)

-———-谷歌翻译———–

索赔现在由于某种原因而暂停(合同说在GMT下午4点重新开始)。

还将费用降低到0.0075 ETH

…

难怪普莱斯越来越

到目前为止,已经声称只有4000万美元的移动(?)

[

](https://x.com/gtx360ti/status/1866320935466533305/photo/1)

[

](https://x.com/gtx360ti/status/1866320935466533305/photo/2)

[

](https://x.com/gtx360ti/status/1866320935466533305/photo/3)

引用

@gtx360ti

·

2024年12月10日

[

](https://x.com/gtx360ti/status/1866303969292665243/photo/1)

[

](https://x.com/gtx360ti/status/1866303969292665243/photo/2)

lol what is this bs @movementlabsxyz taking 0.015 ETH for every airdrop claim now? mainnet fees went down and movement labs added a 0.015eth fees on their own to stop people from claiming lol. $MOVE

-———-谷歌翻译———–

大声笑这是什么BS @MovementLabSxyz为每次AIRDROP声称的0.015 ETH占据了什么?

主网费下降了,运动实验室自己增加了0.015th的费用,以阻止人们声称大声笑。

$移动

[

9.3万

](https://x.com/gtx360ti/status/1866320935466533305/analytics)

[

](https://x.com/gtx360ti)

1200

@gtx360ti

·

why did my allocation go from 1004 $MOVE to 210 move now?

-———-谷歌翻译———–

为什么我的分配从1004 $移动到现在移动210?

并仍收取索赔空调的费用

[

](https://x.com/gtx360ti/status/1866378252174180401/photo/1)

[

](https://x.com/gtx360ti/status/1866378252174180401/photo/2)

引用

@gtx360ti

·

2024年12月10日

[

](https://x.com/gtx360ti/status/1866303969292665243/photo/1)

[

](https://x.com/gtx360ti/status/1866303969292665243/photo/2)

lol what is this bs @movementlabsxyz taking 0.015 ETH for every airdrop claim now? mainnet fees went down and movement labs added a 0.015eth fees on their own to stop people from claiming lol. $MOVE

-———-谷歌翻译———–

大声笑这是什么BS @MovementLabSxyz为每次AIRDROP声称的0.015 ETH占据了什么?

主网费下降了,运动实验室自己增加了0.015th的费用,以阻止人们声称大声笑。

$移动

[

4.3万

](https://x.com/gtx360ti/status/1866378252174180401/analytics)

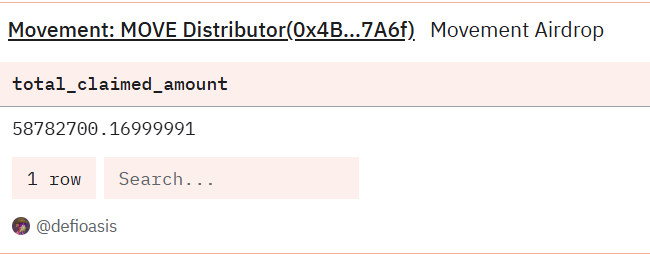

The result was obvious, only 58.7M MOVE claimed. So out of the 1b MOVE that was supposed to be claimed, only 5% was claimed.

[

](https://x.com/VannaCharmer/article/1904203981456539972/media/1904034036323852288)

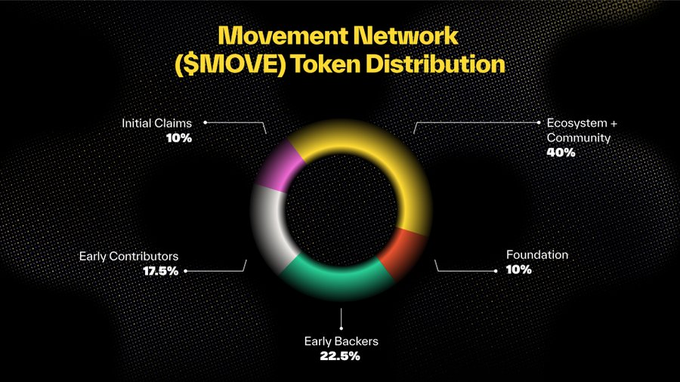

Let’s do the same thing we did with Mantra. According to CoinMarketCap, the self-reported circulating supply of MOVE is 2.450.000.000

[

](https://x.com/VannaCharmer/article/1904203981456539972/media/1904039865366532096)

According to Move’s pie chart though, there should only be 2B (Foundation + Initial claims) tokens circulating post-claims so the shady shenanigans start here since 450.000.000 MOVE are already unaccounted for.

[

](https://x.com/VannaCharmer/article/1904203981456539972/media/1904195841709223936)

2.450.000.000 MOVE (Self-reported circulating supply) - 1.000.000.000 MOVE (Foundation allocation) - 941.000.000 MOVE (unclaimed supply) = 509M MOVE or $203m REAL float

The REAL float is only 20% of the reported circulating supply!!! It’s also hard for me to believe that all of the 509M MOVE that are circulating are in the hands of users, but we’ll leave it be for now and assume this is the real float.

What has happened during this time, in which the REAL float has been extremely low?

- Movement paid WLFI to buy their token

- Movement paid REX-Osprey for them to file an ETF for MOVE.

- Rushi went to NYSE

- Movement engaged in different shenanigans with funds and market makers and sold them locked tokens for cash so they could bid and pump the price.

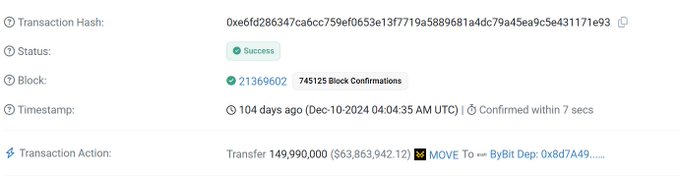

- Team deposited 150M MOVE on Bybit at the pico-top. They probably started selling at the top since the token has been down only since.

- Paid a Chinese KOL shop 700k/mo before and after TGE so they could get listed on Binance and get extra exit liquidity in Asia

[

](https://x.com/VannaCharmer/article/1904203981456539972/media/1904045677824315392)

Coincidence? I don’t think so

As Rushi would say:

[

](https://x.com/VannaCharmer/article/1904203981456539972/media/1904030381294436353)

Kaito:

is the only project on this list that has a real product. Yet, they’ve also engaged in similar behavior with their current airdrop.

[

](https://x.com/Cbb0fe)

1488

1769

CBB

@Cbb0fe加密KOL

·

People really believe only 32% of $KAITO airdrop has been claimed. Truth is less than 4% of $KAITO supply was allocated to users - never has been 10%. While allocating 2% to Binance. Low float VC coin playbook. Criminal.

-———-谷歌翻译———–

人们真的认为,据称只有$ kaito airdrop的32%。

真相不到$ KAITO供应的4%分配给用户 - 从来没有10%。

同时分配2%的二人。

低Float VC硬币剧本。刑事。

[

](https://x.com/Cbb0fe/status/1903874454016372905/photo/1)

[

7.2万

](https://x.com/Cbb0fe/status/1903874454016372905/analytics)

As CBB points out above, Kaito distributed their airdrop but only a small percentage of people claimed. This also affects the real float, let’s calculate it:

[

](https://x.com/VannaCharmer/article/1904203981456539972/media/1904049203594272768)

Kaito has a circulating supply of 241M or $314m according to Coinmarketcap. I’m assuming this is number accounts for: Binance hodlers, liquidity incentives, foundation allocation and initial Community & claim.

Let’s break it down to find out what the real float is:

Real float = 241000000 KAITO- 68000000 (Number of people who didn’t claim) + 100000000 (Foundation) = 73M Kaito

The real float is equivalent to 94.9M Market cap, which is significantly lower than that reported by CMC.

Kaito is the only project on this list to which I’m willing to give the benefit of the doubt as they at least have a revenue generating product and, to my knowledge, haven’t engaged in as much shenanigans as the two other teams here.

Solutions and conclusions:

- CMC and Coingecko should be listing the real float of tokens, not whatever bullshit teams submit.

- Binance, et al should actively penalize this behavior one way or another. The current listings model is broken as you can just pay a KOL shop to increase your engagement in Asia pre-TGE as Movement did.

- Prices might have moved from the time when I wrote this article but for reference I take Move as $0.4, KAITO as $1.3 and Mantra as $6

- If you’re a trader, stay away from these tokens as the teams can move the price whichever way they see fit. They control all the float and hence the flows and price of the token (NFA).

Africa.